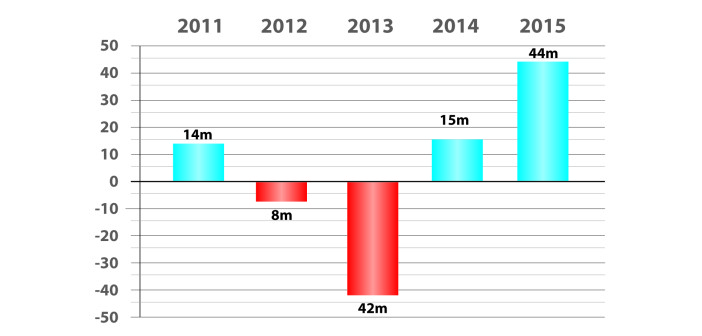

Chart: MSHA Net Debt Paydown: Decrease in Long Term Debt. Fiscal year-by-year net change in debt of Mountain States Health Alliance, 2011-2015. Bar above the baseline represents millions of dollars in decrease of debt. Below the line represents debt increase. At June 30, 2011, MSHA’s debt stood at $1.041 billion. At June 30, 2015 it was $1.032 billion. Note: Per MSHA Corporate Treasurer Marvin Eichorn, the system projects it will make additional (above scheduled) debt payments of $190 million through 2020.

By Jeff Keeling

Editor’s note: This is a continuation of an article from last week on the fiscal 2015 financial results of Mountain States Health Alliance and Wellmont Health System. The complete article first ran in the December Business Journal.

Two major factors relating to insurance and patient revenues provided some headwinds to both systems in fiscal 2015, which ended June 30. One was the failure of Tennessee or Virginia to reverse course and accept the proffered federal Medicaid expansion, which would increase the number of very low income people eligible for the federal insurance. “We would have had less self-pay and less bad debt if we had Medicaid expansion, clearly,” Wellmont CFO Alice Pope said.

Neither system is budgeting for such a scenario. Pope and MSHA COO and corporate treasurer Marvin Eichorn each mentioned a sliver of a silver lining. Pope called it “the woodwork effect.” In states that haven’t expanded Medicaid, the attention generated has led to an uptick in people who are eligible for Medicaid (TennCare in Tennessee) but weren’t signed up, signing up.

“That has helped some,” Pope said. “It would have been better if we had had Medicaid expansion, but we didn’t and it’s just something we have to work with.”

Another thing the systems have to work with is a rise in the number of patients on high deductible plans. More and more working families with insurance in the $40,000 to $75,000 annual family income range have such plans. Pope said she believes such plans represent a step in the right direction toward consumers becoming more involved in and knowledgeable about their health care, but she and Eichorn both said the transition is creating some bumps.

Some of those bumps are hitting the systems’ bottom lines. For instance, MSHA’s “allowance for doubtful accounts” as a percentage of its accounts receivable increased by more than a third in 2015. Many of the increasing number of patients with $3,000 to $5,000 deductibles just can’t come up with that kind of money.

“It used to be in the commercial world there were very low deductibles, and we always had some kind of writeoffs, but it was $300, $400,” said Eichorn, who called the trend “very worrisome. It’s something that’s a challenge in terms of running our organization, but these are real people, too, who are in our community.”

He and Pope both said their systems are doing all they can to work with families in these cases. Wellmont, Pope said, has become more flexible in its debt writedown and writeoff approach to help citizens cope with the trend. But getting people accessing preventive care remains a key.

“The worst thing that can happen is if they defer the services they need because of financial concerns and then they end up getting much sicker,” she said.

In counteracting those things that are out of their control – Medicaid expansion, high deductible plans and, according to Eichorn, steeply rising pharmaceutical costs – Eichorn and Pope both said their systems were quite successful in FY 2015. Where the rubber really meets the road – the ratio of patient revenues to expenses – both systems saw improvements, and both Eichorn and Pope lauded the overall effort to control expenses. Wellmont’s net patient revenues as a percentage of total expenses increased from 96.7 to 98.1. MSHA’s rose even more markedly, from 92.9 percent to 96 percent. (Both systems have additional operating revenues that put them in the black.)

Eichorn said MSHA is adapting to the transformation from fee for service to value based payments by, for instance, participating in the Medicare Shared Savings Program (MSSP). The program rewards systems able to lower growth in Medicare fee-for-service costs while meeting performance standards on quality of care. In 2014, participants were measured simply on their reporting of metrics. In 2015, “we actually had to achieve certain quality measures,” Eichorn said.

The program netted MSHA $5.42 million in 2014, and $2.86 million in 2015. Eichorn said the measuring stick will continue to get tougher. But programs like the MSSP, he said, are critical to transitioning the U.S. – providers and patients alike – to a wellness-oriented health care model and a value-based payment system.

Pope had much the same to say about another major factor in health care reform: electronic health records. The federal government has provided “meaningful use” incentive payments to help offset the cost of implementing those systems, though those payments are tapering off and will cease within a couple years (MSHA’s were $18.3 million in 2014 and just $1.9 million in 2015; Wellmont’s were $7.2 million in 2014 and $3.2 million in 2015).

Pope believes the expense will prove to have been worth it, saying, “the future of health care really is dependent upon an electronic health record. That is where a lot of our redundancy and our inefficiencies come.”

While pleased with MSHA’s inpatient volume growth and cost containment in 2015, Eichorn said those accomplishments aren’t easy to duplicate, or to sustain indefinitely – particularly given health care and demographic trends.

“We’re up about 6 percent through the first four months of this fiscal year (through Oct. 30), but we’re not going to be able to continue with that pace,” Eichorn said. “For one thing, folks in our market use inpatient care at a much higher rate than the national average, so we’ve already got this pressure to reduce that.”

On the expense side, Eichorn said, “you eventually run into diminishing returns once you’ve reached a certain level of efficiency.”

Those factors are among the reasons MSHA has embarked on an aggressive debt paydown strategy. The system incurred high debt levels as it grew and purchased hospitals through 2009. Debt ratios have been the biggest impediment to an improvement in MSHA’s BBB-plus credit rating. Last year, it sliced $44 million of its debt partly by paying extra when days cash on hand exceeded a set level. MSHA should see its debt go below $1 billion by the end of fiscal 2016. The system will be eligible to refinance some of its higher-interest bonds over the next few years, and Eichorn said, “you’re going to see over the next three to four years a very substantial amount of our debt (potentially $190 million above scheduled payments) get paid down.”

Debt isn’t as much of a factor for Wellmont, which has no plans to pay extra, Pope said. MSHA’s long-term debt at June 30 was 97 percent of its 2015 revenues, excluding investment income. Wellmont’s debt, at $480 million, was just 59 percent of its revenues.

Regardless of what things may look like at June 30, 2016, when both Pope and Eichorn hope the systems will be facing the future together, the situation for the foreseeable future will involve plenty of reform-driven uncertainty.

“It’s like having one foot on the dock and one foot on the boat,” Pope said. “That is a weird world. It would almost be better if you could just snap your fingers and we go completely from pay for volume on Monday to getting paid for value on Tuesday. Because now, we’re living in both worlds, and that’s where as an industry it’s tough going through all these transitions.”