By Jeff Keeling

None of Johnson City’s commissioners got exactly what he or she wanted from the fiscal 2016 budget proposal Thursday – not even its author – but a slim majority got enough to earn passage of Jenny Brock’s motion, which includes a 25-cent property tax increase.

A year after several tax increase proposals failed 3-2, Vice Mayor Clayton Stout – who voted against an increase last year – joined Brock and Mayor Ralph Van Brocklin in supporting Brock’s proposal. In fact, Stout seconded the motion, three days after he had floated a proposal for a 20-cent increase. After all commissioners save Stout had expressed an opinion on the city’s budget and their thoughts about taxes, spending and services, commissioners David Tomita and Jeff Banyas voted no.

Road resurfacing got the biggest bump from the increase, 10 cents. Schools will receive 5.5 cents of the increase, or $963,000 (see related story, page 3).

The tax increase – Johnson City’s first since 2002 – will add approximately $4,250,000 annually to the city’s revenues. That is an increase of about 5.5 percent over this fiscal year’s total city revenues of $76.7 million. It brings Johnson City’s property tax rate to $1.87 per $100 of assessed value from $1.62, an increase of 15 percent. For the owner of a home valued at $200,000, the current city property tax is $810, and will rise by $125 a year to $935.

By way of comparison, property tax rates in Kingsport are $2.07, and in Bristol, $2.25. Sullivan County’s property tax rate of $2.31 is also higher than Washington County’s current rate of $1.98. Johnson City’s increase brings the combined city/county rate for Johnson Citians to $3.84, compared to $4.38 in Kingsport and $4.56 in Bristol.

While Stout let his vote speak for him, Brock and Van Brocklin staked out significantly different positions from Banyas and Tomita. Commissioners’ final comments came after a budget process that began with City Manager Pete Peterson – at Van Brocklin’s behest – presenting a proposed budget ordinance with a tax increase for the first time in years. The amount at the beginning was 40 cents, and Van Brocklin made it clear Thursday he didn’t even think that was sufficient to return Johnson City to a path toward sustainable growth.

The 25 cents was a 14-cent reduction from the amount approved on second reading, equivalent to $2.4 million. Brock got there with a mix of measures. They included cuts, among them reducing employee raises from 4 percent to 3 percent and cutting the schools’ operating request by $203,000. Revenue projections increased at the eleventh hour, by almost $300,000. And some budget requests were proposed to be funded through debt.

Brock warned that the city still needed to look hard at its long-term infrastructure needs, commitment to public education, its economic development commitment and its continued use of debt or fund balances to fund ongoing expenses.

“If we justify something as a legitimate recurring need, we have to find a legitimate recurring source of revenue for that,” Brock said, adding that that included ongoing infrastructure needs.

“We have streets that we repave once every 50 to 60 years because of the amount of money we have set aside for street repaving. We have a 40-year-old Freedom Hall with an HVAC system that was supposed to last 25 years. These are long-term problems that we haven’t really attended to.”

Tomita, like the other commissioners, noted the respect they share, and echoed Banyas’ previous comments criticizing a newspaper ad that had vilified Van Brocklin, Brock and Stout for their willingness to raise taxes.

“We disagree amongst this group, but I think there’s a respect for differing opinions,” Tomita said. “That’s what makes the world great, that’s what makes this country great, that’s what makes this city great.”

He also said Brock’s work, which included several other revenue sources and savings outside the tax increase, got at some of what he had been suggesting in the budget’s second reading. This included some deployment, smaller than that desired by Tomita, of debt for capital expenditures.

“I respect all the work commissioner Brock put into this,” Tomita said. “It answered a lot of things that we’ve talked about.”

But in addition to saying he was more optimistic about revenue growth without a tax hike, Tomita suggested the city could get along alright with less revenue than some thought it needed.

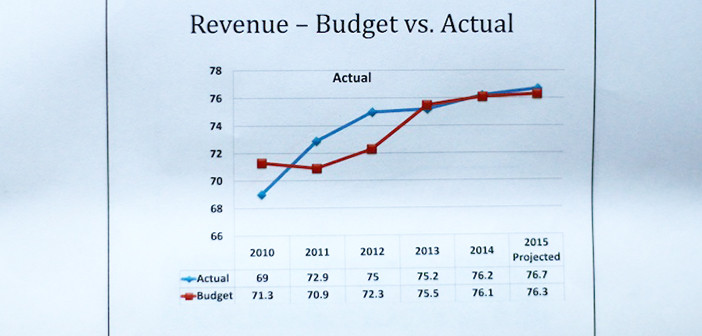

“In 2001, the last time we had a tax increase, the city’s revenues were $53,506,853. Projected … it looks like this year we’ll close the books at $76,762,143.”

Tomita noted that was a 43 percent increase, exceeding even the rate of inflation for the same period. He also said he believes there are ways to generate revenues outside traditional tax increases, and he repeated his contention that the local economy appears to be moving into a phase of stronger growth than it’s seen since the recession.

Conversely, Van Brocklin said he would cast his vote, “with a great deal of reluctance” because he believed the 25-cent increase was inadequate.

“I believed the proposed 40-cent property tax increase was just barely adequate to remain the dominant community in Upper East Tennessee,” Van Brocklin said. He made the comments after explaining that when he ran for the commission, “it was with certain promises, including accelerating the revitalization of downtown, providing a top-notch education to the youth of this community, addressing infrastructure needs, community beautification, and promoting and facilitating economic development in our community.”

Those things, Van Brocklin said, could best be accomplished through the kind of increase he had floated last year – somewhere between 52 and 60 cents. He said he asked Peterson to prepare “a needs-based budget, as opposed to the traditional budget that was put forth where it’s balanced, there’s no tax increase – I intended a budget that would aggressively position us. But he’s a little more pragmatic, a little more realistic than I am in what he anticipates to be possible.”

That said, Van Brocklin said he was voting yes, despite his anticipation of a need for another increase in the near future, the proposal’s use of debt financing, and what he called a short-changing of the schools.

“One of the things that bothers me most in government these days is an unwillingness to compromise to achieve the greatest good possible. So I am going to compromise and reluctantly, on a budget which skirts the edges of adequacy for positioning this community for success, I will cast a yes vote this evening.”

When Banyas spoke, he reiterated his contention that the city needs to “live within its means,” and that revenues have remained largely adequate for keeping Johnson City successful. Banyas, who did express support for increased road resurfacing revenues, said, “The fact is, we’ve done a lot and we’re continuing to do a lot of projects that will keep Johnson City moving forward.”

Banyas said, “not one person on this commission wants to see Johnson City or this school system succeed more than I. I know the value that it brings to the community, and we’re all proud that Johnson City has grown and prospered over the last decade, and that’s the reason that we’ve only had one property tax increase.”

But even on the issue of resurfacing, Banyas said he didn’t think $3 million annually was a magic bullet for the city’s road condition problems.

“I think we have to focus on daily maintenance of our roads, and if it means reallocation of our resources, then that’s what we should do.”

And Banyas returned to an argument he’s made before: that Johnson City’s government still has the ability to do more with less, or at least more with what it has.

“If I thought we were being as productive as we could be, I would fully support additional resources being allocated. Throwing money at a problem rarely solves it. So we can become more productive, or we can ask for more tax money so we don’t have to be more productive. And there comes a point in time where you realize you just have to live within your means.”

Banyas said he hadn’t made any pledge never to raise taxes, “and I fully realize that it’s going to happen at some point in time and I may have to vote to do that. And I would have no problem doing so if I truly felt there was a need. But raising taxes should be our last option, and only done in dire circumstances.”